Lakeland Bank to be renamed

OAK RIDGE. Provident Financial Services and Lakeland Bancorp have agreed to extend their earlier merger deadline to March 31.

Provident Financial Services, parent company of Provident Bank, and Lakeland Bancorp, parent company of Lakeland Bank, have agreed to extend their earlier merger deadline to March 31.

The extension will provide more time to obtain the required regulatory approvals.

In the deal, announced in September 2022, Iselin-based Provident will pay $1.3 billion in stock for Lakeland, based in Oak Ridge.

When the merger is completed, Lakeland Bank branches will be renamed Provident.

A statement from the two companies in December said the merger will create what they dubbed a “super community bank” with more than $25 billion in assets, $20 billion in deposits, and locations throughout New Jersey, New York and Pennsylvania.

The deal originally was expected to close in the second quarter of 2023.

“Both parties remain committed to the merger and to obtaining regulatory approvals,” the banks said in the statement.

After the merger, the bank will “benefit from enhanced scale, opportunities for growth and profitability, and Provident’s and Lakeland’s complementary strengths will provide exceptional service to customers and communities served,” the statement said.

The merger will give Provident 4 percent of all bank deposits in New Jersey, making it second among banks with $100 billion or less in assets, according to a report issued in September.

Businessmen’s dream

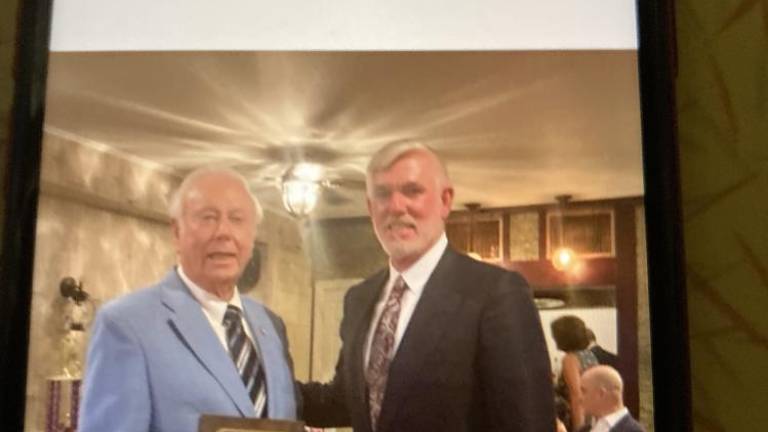

Lakeland Bank was born from a dream of two successful businessmen, John Fredericks and Robert Nicholson, who grew up in rural Oak Ridge. They attended kindergarten through eighth grade in a community rural schoolhouse.

Anna Dunham taught Nicholson in one room as for all eight grades.

A few years later, Fredericks went to the same school after a second room was added to the building. His teachers were Dunham and Alice Greenwood.

Both went to Butler High School when West Milford was one of eight or nine sending districts that did not have their own high schools. Both men are lifelong learners who have studied and completed work at various colleges and universities.

They both now live in Sparta.

Their fathers, Robert Nicholson Sr., and Wilbur Fredericks, were lifelong friends as well as business partners in Oak Ridge. That friendship continues today.

Robert Nicholson started his Eastern Propane business in 1955 and John Fredericks carried on the long-established Fredericks Fuel and Heating business.

As young businessmen, they were frustrated by having to waste time to drive to other towns, then wait in lines because there were no banks in West Milford.

Ernest Warhurst, a local builder, agreed with them that it was possible to establish a bank in the township and he was on board to help, as did many others.

Complicated process

They soon discovered that starting a bank was a long and complicated process. When they applied to the New Jersey Department of Banking for a charter, two existing banks filed objections.

The would-be bankers went to residents, businesspeople and professionals for help. Forty people who were willing to help raise the $1 million in needed capital.

A request to the community raised $1.2 million, three times the amount expected. Each subscriber was allowed to buy up to 100 shares of stock.

Lakeland Bank’s first office, located in a trailer on Route 23 South in Newfoundland, opened May 19, 1969, after the bank charter was approved by the state Banking Department and the Federal Deposit Insurance Corp.

Lakeland State Bank was owned by 500 residents of West Milford and Jefferson.

Nicholson was chairman and Fredericks was president when the seven original directors and officers first met. Other board members were Bruce Bohuny, the board’s secretary; John Pier Jr., a West Milford dentist; Albert Riggs, owner of the Bowling Green Golf Club in Milton; Robert DeBow, then-owner of the Iron Kettle Restaurant in Stockholm; and Edward Steadman, a professional banker hired to oversee the bank operations.

Lakeland introduced Saturday banking and drive-through banking, which were copied by other banks soon afterward.

Fredericks recalled that earnings were in the black in just 90 days with total assets at $2,823,379 on Dec. 31, 1969.

The bank moved into a new building in Newfoundland in 1970 and transferred the bank trailer to a Hewitt location to open a satellite bank.

After the Hewitt building was built in 1972, the trailer was moved on to Ringwood Avenue in Wanaque where another branch of Lakeland Bank opened.

The West Milford branch on Union Valley Road opened in 1992.

The 16,000-square-foot Colonial-style administration building on Oak Ridge Road in Oak Ridge, across the road from Nicholson’s propane business, opened in 1991. In 2000, a 10,000-square-foot addition was put on the original building.

Lakeland Bancorp was formed May 19, 1989, and became the parent company of Lakeland State Bank. The name was changed from Lakeland State Bank to Lakeland Bank in 1997.

By 2014, Lakeland Bank had $1 billion in assets, more than $85 million in capital and annual net earnings of more than $11 million as well as 33 offices and 400 employees.